CA Intermediate Syllabus for May 2023: Overview

In the Chartered Accountancy course, the CA Intermediate is the second-level course in the structure allowing students to have a deeper understanding of Accounting, law, and finance.

Students can register for the CA Intermediate course after passing the foundation exams. While one studies four subjects in the Foundation course, there are eight subjects to be studied. Following are the eight subjects in two groups. Read the article, to get a detailed overview of CA Intermediate Syllabus 2023.

| Paper | CA Intermediate Group-I Subjects |

|---|---|

| 1 | Accounting |

| 2 | Corporate and other laws |

| 3 | Cost and management accounting |

| 4 | Taxation |

| CA Intermediate Group-II Subjects | |

| 5 | Advanced Accounting |

| 6 | Auditing and Assurance |

| 7 | Enterprise Information Systems & Strategic Management |

| 8 | Financial Management and Economics for Finance |

In this post, we will provide you with the details of the CA Inter syllabus apt for the students who have registered with the revised scheme. Students having registered after 17th July 2017 are eligible to appear in CA Intermediate examinations.

Must Read: Complete Overview of CA Intermediate Course

CA Inter New Syllabus Updates 2023:

The Institute of Chartered Accountants of India (ICAI) has made changes in the syllabus of CA intermediate Exams for May 2023 exam. ICAI has introduced some new topics and cut down some old topics from the Intermediate syllabus. Mentioned below are all the necessary changes in the CA Syllabus made by ICAI for May 2023 examination.

Extra add-on topics in the CA Intermediate Syllabus 2023:

All the updates which are made by the ICAI for the May 2023 exam are mentioned below:

- Paper 1 topic of accounting has been shifted to advanced accounting, paper 5.

- ICAI has made additions of dissolution of Partnership firms along with piecemeal distribution of assets including the conversion of partnership firm into a company and sale to a company which is an issue related to accounting in limited liability partnerships.

Deduction of Topics in the CA Inter Syllabus May 2023:

All the topics which are deducted from the CA Intermediate Syllabus for May 2023 by the ICAI are mentioned below:

- Underwriting of shares and debentures.

- Valuation of goodwill.

- Application of Guidance Notes on specified accounting aspects published by the ICAI.

- Financial Reporting of Insurance Companies and Mutual Funds and regulatory requirements thereof.

CA Intermediate Syllabus PDF 2023 – Download PDF

PAPER 1 – ACCOUNTING

(One paper – Three hours – 100 Marks)

Objective:

To acquire the ability to apply specific accounting standards and legislations to different transactions and events and in preparation and presentation of financial statements of various business entities.

CA Intermediate Syllabus PDF for Accounting: Download PDF

| Chapter | Chapter Names |

|---|---|

| 1 | Process of formulation of Accounting Standards including Ind ASs (IFRS converged standards) and IFRSs; convergence vs adoption; objective and concepts of carve-outs. |

| 2 | Framework for Preparation and Presentation of Financial Statements (as per Accounting Standards). |

| 3 | Applications of Accounting Standards |

| 4 | Company Accounts |

| 5 | Accounting for Special Transactions |

| 6 | Special Type of Accounting |

PAPER – 2: CORPORATE AND OTHER LAWS

(One paper – Three hours – 100 Marks)

PART I – COMPANY LAW (60 MARKS)

Objective:

To develop an understanding of the provisions of company law and acquire the ability to address application-oriented issues.

CA Intermediate Syllabus PDF for Corporate and Other Laws: Download PDF

| The Companies Act, 2013 – Sections 1 to 148 | |

|---|---|

| Topic | Topic Names |

| 1 | Preliminary |

| 2 | Incorporation of Company and Matters Incidental thereto |

| 3 | Prospectus and Allotment of Securities |

| 4 | Share Capital and Debentures |

| 5 | Acceptance of Deposits by companies |

| 6 | Registration of Charges |

| 7 | Management and Administration |

| 8 | Declaration and payment of Dividend |

| 9 | Accounts of Companies |

| 10 | Audit and Auditors |

Note: The provisions of the Companies Act, 1956 which are still in force would form part of the syllabus till the time their corresponding or new provisions of the Companies Act, 2013 are enforced.

PART II- OTHER LAWS (40 MARKS)

Objectives:

- To develop an understanding of the provisions of select legislations and acquire the ability to address application-oriented

- To develop an understanding of the rules for interpretation of statutes

| Chapter | Chapter Names |

|---|---|

| 1 | The Contract Act, 1872 |

| 2 | The Negotiable Instruments Act, 1881 |

| 3 | The General Clauses Act, 1897 |

| 3 | Prospectus and Allotment of Securities |

| 4 | Interpretation of statutes |

Note: If new legislations are enacted in place of the existing legislation, the CA intermediate syllabus would include the corresponding provisions of such new legislation with effect from a date notified by the Institute. Similarly, if any existing legislation ceases to have an effect, the syllabus will accordingly exclude such legislation with effect from the date to be notified by the Institute.

The specific inclusions/exclusions in the various topics covered in the syllabus will be effected every year by way of Study Guidelines if required.

PAPER – 3: COST AND MANAGEMENT ACCOUNTING

(One Paper- Three hours- 100 Marks)

Objectives:

- To develop an understanding of the basic concepts and applications to establish the cost associated with the production of products and provision of services and apply the same to determine

- To develop an understanding of cost accounting

- To acquire the ability to apply information for cost ascertainment, planning, control, and decision

CA Intermediate Syllabus PDF for Cost and Management Accounting: Download PDF

| Chapter | Chapter Names |

|---|---|

| 1 | Overview of Cost and Management Accounting |

| 2 | Ascertainment of Cost and Cost Accounting System |

| 3 | Methods of Costing |

| 4 | Cost Control and Analysis |

PAPER – 4: TAXATION

(One paper ─ Three hours – 100 Marks)

Objective:

To develop an understanding of the provisions of income-tax law and goods and services tax law and to acquire the ability to apply such knowledge to make computations and address application-oriented issues.

SECTION A: INCOME TAX LAW (60 MARKS)

CA Inter Syllabus PDF for Income Tax Law: Download Now

| Chapter | Chapter Names |

|---|---|

| 1 | Basic Concepts |

| 2 | Residential Status and scope of total income |

| 3 | Incomes that do not form part of total income (other than charitable trusts and institutions, political parties, and electoral trusts) |

| 4 | Heads of income and provisions governing the computation of income under different heads |

| 5 | The income of other persons included in the assessee’s total income |

| 6 | Aggregation of income; set-off, or carry forward and set-off of losses |

| 7 | Deductions from gross total income |

| 8 | Computation of total income and tax liability of individuals |

| 9 | Advance tax, tax deduction at source, and Introduction to tax collection at source |

| 10 | Provisions for filing return of income and self-assessment |

SECTION B – INDIRECT TAXES (40 MARKS)

CA Inter Syllabus PDF for Indirect Taxes: Download PDF

| Chapter | Chapter Names |

|---|---|

| 1 | Concept of Indirect Taxes |

| 2 | Goods and Service Tax (GST) Laws |

Note – If any new legislation(s) is enacted in place of existing legislation(s), the CA intermediate syllabus 2023 will accordingly include the corresponding provisions of such new legislation(s) in place of the existing legislation(s) with effect from the date to be notified by the Institute. Similarly, if any existing legislation ceases to have an effect, the CA inter syllabus will accordingly exclude such legislation with effect from the date to be notified by the Institute. Students shall not be examined with reference to any particular State GST Law.

Consequential/corresponding amendments made in the provisions of the Income-tax law and Goods and Services Tax laws covered in the syllabus of this paper which arise out of the amendments made in the provisions not covered in the syllabus will not form part of the syllabus. Further, the specific inclusions/exclusions in the various topics covered in the syllabus will be effected every year by way of Study Guidelines. Specific inclusions/exclusions may also arise due to additions/deletions every year by the annual Finance Act.

GROUP II- PAPER 5: ADVANCED ACCOUNTING

(One paper – Three hours – 100 Marks)

Objectives:

- To acquire the ability to apply specific Accounting Standards and legislations to different transactions and events and in preparation and presentation of financial statements of business entities;

- To understand and apply financial reporting and regulatory requirements of Banking Companies and NBFCs.

CA Inter Syllabus PDF for Advanced Accounting: Download PDF

| Chapter | Chapter Names |

|---|---|

| 1 | Application of Accounting Standards |

| 2 | Special Aspects of Company Accounts |

| 3 | Reorganization and Liquidation of Companies |

| 4 | Banking Companies and Non-Banking Financial Companies and regulatory requirements thereof |

| 5 | Consolidated Financial Statements |

| 6 | Dissolution of partnership firms |

Notes :

- If either new Accounting Standards (ASs), Announcements, and Limited Revisions to ASs are issued or the earlier ones are withdrawn or new ASs, Announcements, and Limited Revisions to AS are issued in place of existing ASs, Announcements, and Limited Revisions to AS, the syllabus will accordingly include/exclude such new developments in the place of the existing ones with effect from the date to be notified.

- The specific exclusions, in any topic covered in the syllabus, will be affected, if any, by way of the Study

PAPER 6: AUDITING AND ASSURANCE (100 MARKS)

(One paper – Three hours – 100 Marks)

Objective:

To develop an understanding of the concepts in auditing and of the generally accepted auditing procedure techniques and skills and acquire the ability to apply the same in audit and attestation engagements.

Syllabus of CA Intermediate for Auditing and Assurance: Download PDF

| Chapter | Chapter Names |

|---|---|

| 1 | Nature, Objective, and Scope of Audit |

| 2 | Audit Strategy, Audit Planning, and Audit Programme |

| 3 | Audit Documentation and Audit Evidence |

| 4 | Risk Assessment and Internal Control |

| 5 | Fraud and Responsibilities of the Author in this Regard |

| 6 | Audit in an Automated Environment |

| 7 | Audit Sampling |

| 8 | Analytical Procedures |

| 9 | Audit of Items of Financial Statements |

| 10 | The Company Audit |

| 11 | Audit Report |

| 12 | Audit of Banks |

| 13 | Audit of Different Types of Entities |

Note:

- The specific inclusions/exclusions, in any topic covered in the CA intermediate syllabus May 2023, will be effected every year by way of Study Guidelines.

- The provisions of the Companies Act, 1956 which are still in force would form part of the syllabus till the time their corresponding or new provisions of the Companies Act, 2013 are enforced.

- If new legislations/ Standards on Auditing/Guidance Notes/Statements are enacted in place of the existing legislations, the syllabus would include the corresponding provisions of such new legislations with effect from a date notified by the changes in this regard would also form part of Study Guidelines.

PAPER – 7: ENTERPRISE INFORMATION SYSTEMS AND STRATEGIC MANAGEMENT

(One paper – Three hours – 100 Marks)

SECTION A: ENTERPRISE INFORMATION SYSTEMS (50 MARKS)

Objective: To develop an understanding of technology-enabled Information Systems and their impact on enterprise-wide processes, risks, and controls.

Syllabus of CA Intermediate for Enterprise Information Systems: Download PDF

| Chapter | Chapter Names |

|---|---|

| 1 | Automated Business Processes |

| 2 | Financial and Accounting Systems |

| 3 | Information Systems and its Components |

| 4 | E-commerce, M-commerce, and Emerging Technologies |

| 5 | Core Banking Systems |

SECTION B: STRATEGIC MANAGEMENT (50 MARKS)

Objectives

To develop an understanding of strategic management concepts and techniques and acquire the ability to apply the same in business situations.

| Chapter | Chapter Names |

|---|---|

| 1 | Introduction to Strategic Management |

| 2 | Dynamics of Competitive Strategy |

| 3 | Strategy Management Process |

| 4 | Corporate Level Strategies |

| 5 | Business Level Strategies |

| 6 | Functional Level Strategies |

| 7 | Organization and Strategic Leadership |

| 8 | Strategy Implementation and Control |

PAPER – 8: FINANCIAL MANAGEMENT AND ECONOMICS FOR FINANCE

(One paper – Three hours – 100 Marks)

SECTION A: FINANCIAL MANAGEMENT (60 MARKS)

Objective: To develop an understanding of various aspects of Financial Management and acquire the ability to apply such knowledge in decision-making.

| Chapter | Chapter Names |

|---|---|

| 1 | Financial Management and Financial Analysis |

| 2 | Financing Decisions |

| 3 | Capital Investment and Dividend Decisions |

| 4 | Management of Working Capital |

SECTION B: ECONOMICS FOR FINANCE (MARKS: 40)

Objective:

To develop an understanding of the concepts and theories of Economics in the context of Finance and acquire the ability to address application-oriented issues.

| Chapter | Chapter Names |

|---|---|

| 1 | Determination of National Income |

| 2 | Public Finance |

| 3 | The Money Market |

| 4 | International Trade |

Related Article: CA intermediate study material 2023

Frequently Asked Questions on CA Intermediate Syllabus 2023:

Q. What are the terms for the usage of calculators by ICAI?

Ans. Students can use a battery-operated portable calculator with up to 12 digits, 2 memories. and 6 functions.

Q. Are there any deductions in marks for wrong answers in CA Intermediate Exams?

Ans. No, there is no negative marking applicable for wrong answers.

Q. How many attempts are allowed in CA Intermediate Exams?

Ans. A total of 8 attempts are allowed for Chartered Accountancy students for CA Intermediate Exams. Upon 8 attempts the student has to renew the registration to appear for the exam again.

Q. What are the criteria for passing the Intermediate Exams?

Ans. You need to fulfill the following conditions to pass:

- Minimum of 40% marks on each paper

- An aggregate of 50% of marks in all papers

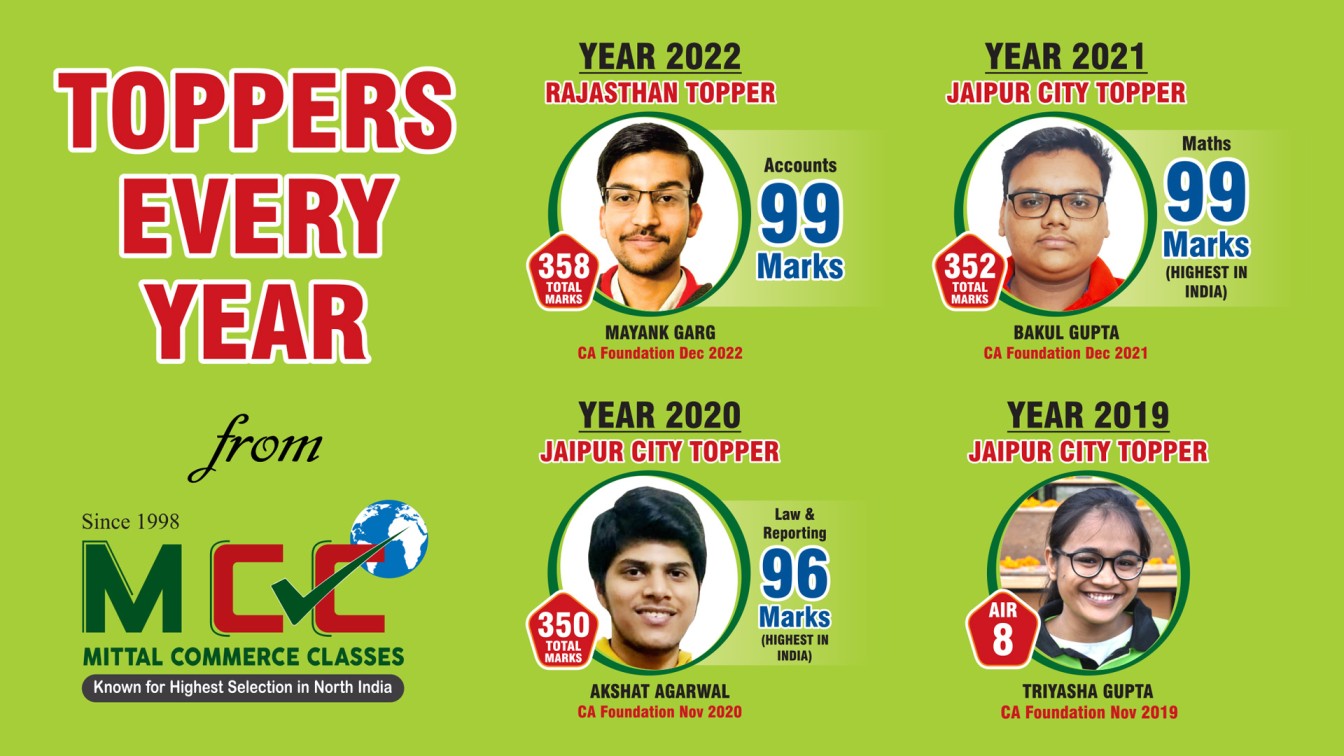

For Online/Offline CA Intermediate classes, join Mittal Commerce Classes now.