Do you have a question about How to Become CA in India?, then you are on the right article. Here we will tell you to step by step procedure for becoming Chartered accountant in India and complete details about the CA Course. This article is a 2024 updated CA course guide for students who aspire to become a chartered account.

An accountant is a profession to manage the financial liability of all the business. And in 2022, we anticipate the financial sector getting a history boom again. This time implementing Direct Tax, GST, Demonetization, and many sectors getting organized, created humongous opportunities for Accountant.

With the response to the current scenario, the CA profession has become the apple of every teenager’s eye. This article will help us to understand the basic question of How To Become a Chartered Accountant in India after 12th, and accordingly plan your professional course.

Want to Book your Seat: Register today with our CA online classes

The snapshot will let you know the eligibility criteria, the validity of the registration. The CA Course fees for registration, examination month and subjects of all the levels of CA course. After all the hard work and complete dedication for 4.5 to 5 years, students become a CA to earn around 7 lakhs per annum which is the starting salary of a CA in India. CA is a professional course pursued to become a Chartered Accountant who can take care of all the financial and tax matters related to any individual, small and midcap firm or industries, big industries and Big MNCs.

Chartered Accountant Course 2024 (Details):

The snapshot will let you know the eligibility criteria, registration fees & it’s validity, examination month and subjects of all the levels of Chartered accountancy course:

| CA Foundation Course 2024 | CA Intermediate Course 2024 | CA Final Course 2024 |

|

| Last date of registration for May/June 2024 | Before 1st February and August 2024 | Before 1st September and March 2024 | Before 1st November and May 2024 |

| Examination held | June and December | May and November | May and November |

| Validity of registration | 4 years | 5 year | 10 year |

| Subjects | 4 | 6 | 6 |

| Fees | Rs 9800 | Rs 18000 | Rs 22000 |

| Eligibility | Should appear 12th exams | Should clear foundation or graduation or PG | Should clear intermediate level and 2 year practical training |

Must Check: CA Exam Time Table 2024

For proper understanding let’s follow the step by step procedure towards this program. According to latest updates, ICAI has revised the format of Chartered accountancy course. They have introduced a Foundation course against CPT, Intermediate course against IPCC and new final course against the old final course. The entire CA course duration is around 4.5 years, If a student clear every exam in the first attempt.

Different stages of CA course with effect from September 2017, are

- CA Foundation Course

- CA Intermediate Course

- CA Articleship

- CA Final Course

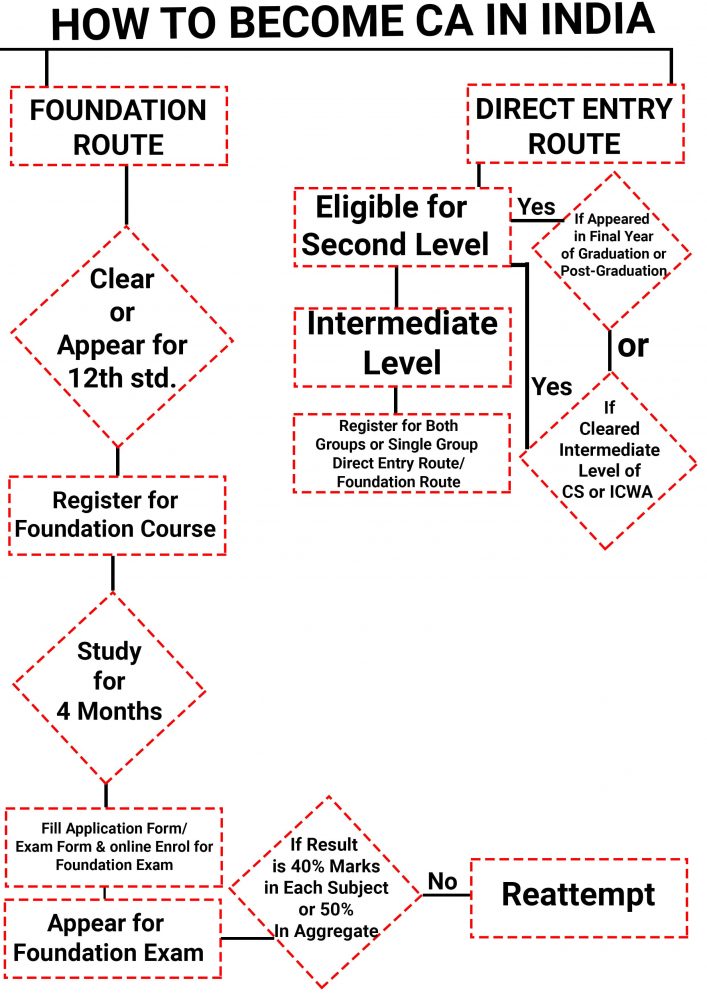

Here is a solution to your question of how to become a CA in India? Follow the basic steps to become a CA in India.

Procedure/Steps To become CA in India 2024:

To become CA (Chartered Accountant) in India 2024 you have to follow four basic steps and the first step is to clear the CA Foundation Course exams.

Step 1: Firstly You Need To Register Yourself for CA Foundation Course

Eligibility – You need to clear your 12th standard in any stream (arts, science, commerce) with a minimum of 33% of marks.

Foundation Registration – CA Foundation registration process includes filling up basic details online at ICAI official website and attaining a registration number, user id, and password.

Study Period and Exam Form – You have a study period for 4 months after your registration to appear for your exams. You have to fill the CA Foundation exam form to get the CA Foundation admit card to enter the examination center.

Foundation Exams – They are held twice a year in the month of June and December and for this exam, you have to register in the month of February and August respectively.

Fees – CA Foundation fees is Rs 9800 which include registration fees, examination fees, online form fee and journal for member and students.

Paper’s Pattern – There are four subjects related to basic accounting and auditing principles of 100 marks each. Where 2 paper is subjective types and the other 2 are objective type paper.

CA Foundation subjects which are as follows:

- Paper 1: Accounting

- Paper 2: Business Laws

- Paper 3: Quantitative Aptitude

- Paper 4: Business Economics

Result – The CA Foundation result 2023 for December month will be declared in the month of February 2024.

Validity – This course is valid for 4 years and re-validation is not allowed in CA foundation level.

Passing Marks – There are four subjects related to basic accounting and Law, Economics principles of 100 marks each. And You are eligible for intermediate level when you clear the CA foundation exams with 40 % mark in each subject or 50% aggregate.

You can read our article How to prepare for the CA foundation exam to know the CA Foundation exam pattern and preparation strategies to get good marks in the exams.

You can prepare for exams through the CA Foundation syllabus 2024 , CA Foundation study material, CA Foundation Practice Manual, CA foundation Mock Test Papers and CA Foundation question papers, CA Foundation model question papers to score good marks in your exams.

Step 2: Register Yourself for the CA Intermediate Course 2024

You can register in the CA intermediate course under two-approach:

1. How to become a Chartered Accountant after 12th?

Foundation route where you clear your foundation exams.

2. How to Become a Chartered Accountant after Graduation?

Direct entry route where you clear your graduation and post-graduation and directly enter to intermediate level, skipping the first level.

Inter Registration and Exams – Registration for Intermediate is made in the month of March and September for which exams are held in the month of November and May.

Validity – The validity for registration is for 5 years and you can re-validate only once in CA intermediate level.

Study Period – There should be a gap of 8 months of study period between your registration and examination.

You can read our article on the CA Intermediate study plan and know the pattern of exams and strategies to clear your exams easily.

Exam Form and Admit Card – You register for the Intermediate exam by filling CA Intermediate exam form or Application form online and download the CA Intermediate Admit card 2023.

Exam Pattern – Intermediate Course is broadly divided into two groups. Where group 1 included 3 subjects of 100 marks each and group 2 also include 3 subjects of 100 each.

You should prepare for exams through the syllabus, CA Intermediate study material, Practice Manual, CA Intermediate Mock Test Papers and question papers of Intermediate level subjects which are as follows:

CA Course Subjects – There are 3 subjects in each group

Group 1:

Paper-1: Accounting (100 Marks)

Paper-2: Corporate & Other Laws (100 Marks

Paper-3: Taxation (100 Marks)

- Section A: Income-tax Law (50 Marks)

- Section B: Goods and Services tax (50 Marks)

Group 2:

Paper-4: Cost and Management Accounting (100 Marks)

Paper-5: Auditing and Assurance (100 Marks)

Paper-6: Financial Management and Strategic Management(100)

- Part I: Financial Management( 50 marks)

- Part II: Strategic Management (50 marks)

Total Fees – The total Registration fee for CA intermediate is 18000 for both groups) which include registration fees, student activities fees, registration for article assistant, AICITSS fees and examination fees respectively.

Students of intermediate have to undergo AICITSS training for 4 weeks. The training can only be done after clearing one group of both groups, after the completion of training and clearing both the group.

After the completion of training and clearing both groups, you are eligible for CA final level with step 3.

Step 3: Enrolling for Articleship And Finals

After completion of an intermediate level, we step down to the final level. The final stage is consist of both practical and theoretical exams.

Articleship – You can register for Articleship after completing any one single group of intermediate and can commence the practical training after completing both groups of intermediate. You undergo 2 years of mandatory training or Articleship and start receiving a stipend during Articleship training. In the last 6 month of practical training, you can register for Final level and appear for the exam by filling the CA Final exam form or application form online. After completion of 2 years of Articleship students can register for Assessment tests and take the test in any subsequent quarter of registration.

You undergo 2 years of mandatory training (Articleship) during this time.

Final Registration – There is no last date for registering the CA final course but you need to register before you appear for your final exams.

Validity – Final exams are held in May and November. And the validity of the registration is for 10 years.

Total Fees – The total fees paid in CA final is Rs 25300 for both group (22000+3300) which included registration fees, examination fees and others).

Passing Marks – The final course is divided into two groups with 3 subjects in each group. All subjects is for 100 marks and you need to acquire 40% marks in all subjects or 50% marks in aggregate to clear the exams.

Result – The CA Final result is declared within one month of the last date of examination.

The subjects for Final level are:

Paper-1: Financial Reporting

Paper-2: Advanced Financial Management

Paper-3: Advanced Auditing, Assurance and Professional Ethics

Paper-4: Direct Tax Laws & International Taxation

Paper-5: Indirect Tax Laws

Paper-6: Integrated Business Solutions

The final level is the toughest level of all levels. You can read our article CA Final preparation to understand the Final exam pattern and know tips and strategies to score good marks.

Another successful way to score good marks is by continuous practice of CA Final Mock test Papers, Practice manual, RTP, CA Final study material, previous year question paper, suggested answers, according to updated Syllabus and study material.

After clearing both the groups and undergoing 2 years of practical training which includes 4 weeks of AICITSS you will acquire membership of ICAI family.

‘You are now a CA.”

To be a CA is a commitment for a minimum of 4 years and involves a lot of hard work and practice. Though it is one of the toughest course in the world it’s possible to crack it down with persistence and devotion.

Hope you find this article useful to solve your queries like how to become a Chartered Accountant in India, How many years it takes to become a CA India or the process to become a CA. We wish you good luck.