ICAI Proposed CA New v/s Old Scheme | Latest Updates

The Institute of Chartered Accountants of India (ICAI) has recently offered a new scheme of education and training for Chartered Accountants. This revised scheme has made various changes to all three levels of the CA Course, as well as the practical training period of three years.

The ICAI New Scheme for 2023 exams has revised the CA Course, which consists of three levels: CA Foundation course, CA Inter course, and CA Final course. Few sections have been removed, some have been merged together, and some new changes have been implemented. Additionally, The CA articleship period has been reduced from 3 to 2 years in the updated scheme.

| ICAI CA Courses | New Changes |

| CA Foundation | 4 Papers |

| CA Intermediate | 6 Papers (3 Papers in Each Group) |

| CA Articleship | Duration Reduced from 3 to 2 years |

| CA Final | 6 Papers (3 Papers in each Group) |

ICAI proposed a Plan of Action to Become a Chartered Accountant

| CA Course Level | Existing Scheme | New Scheme |

| CA Foundation Registration/ Appear 10 + 2 | Start | Start |

| CA Foundation Study Period | 4 Months | 4 Months |

| CA Intermediate Study Period | 8 Months | 8 Months |

| CA Articleship | 36 Months | 24 Months |

| CA Final Study Period | – | 6 Months |

| Total CA Course Duration | 48 Months | 42 Months |

| Work Experience for CoP | – | 12 Months |

ICAI CA New Scheme 2023 Applicability Date – Latest Update

The Institute of Chartered Accountants of India (ICAI) has not yet announced the applicable date for the New Scheme 2023. However, it is expected that the new scheme will become effective from May 2024.

ICAI CA Foundation New Scheme and Old Scheme Differences

Presently, there is no restriction on the amount of tries for the CA Foundation course. Therefore, students have the choice to attempt the course as many times as needed. The registration validity for the CA Foundation can also be renewed multiple times.

If the new scheme of education and training is implemented, students can register after completing 10th grade and the registration for the CA Foundation will be valid for four years. After satta king the expiration of the 4 years, students will not be able to renew their foundation registration.

There won’t be any fixed deadlines such as January 1st and July 1st for CA Foundation registration anymore. This will allow ICAI to hold three exams a year.

CA Foundation New Syllabus 2023

| New Syllabus | Old Syllabus | |

| Paper 1 | Accounting (100 Marks) | Principles and Practices of Accounting |

| Paper 2 | Business Laws (100 Marks) | Business Laws and Business Correspondence and Reporting |

| Paper 3 | Quantitative Aptitude (100 Marks) Business Mathematics Logical Reasoning Statistics |

Business Mathematics and Logical Reasoning and Statistics |

| Paper 4 | Business Economics (100 Marks) | Business Economics and Business & Commercial Knowledge |

The Institute of Chartered Accountants of India (ICAI) has recently revised the CA Foundation syllabus, removing two subjects: Business Correspondence & Reporting and Business & Commercial Knowledge. This CA Foundation syllabus comprises 6 subjects and 4 papers.

CA Foundation Passing Criteria

The ICAI has implemented some revisions in the CA Foundation exam structure. Now, candidates must score 50% or higher to pass the CA Foundation exams and each incorrect MCQ answer will result in a deduction of 0.25 points.

If you are getting ready for the 2023 exams, then signing up for the CA Foundation coaching from Mittal Commerce Classes is a great choice. Our courses are designed with the most up-to-date ICAI examination pattern and study materials.

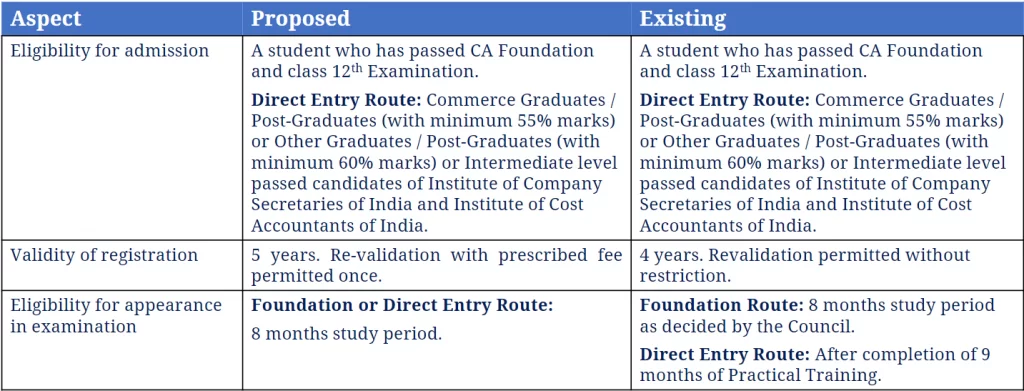

ICAI CA Intermediate New Scheme and Old Scheme Differences

In the CA Intermediate eligibility criteria, to take the CA Intermediate course, the same qualifications are required as they were previously. However, students who have chosen the direct entry route must now dedicate 8 months to studying in order to be eligible to sit for the exams.

The CA Intermediate registration is now valid for a period of 5 years instead of 4, and students are able to extend their registration by paying the necessary fees only once.

CA Intermediate New Syllabus 2023

| New Syllabus | Old Syllabus |

| Paper 1: Advanced Accounting | Paper 1: Accounting

Paper 5: Advanced Accounting |

| Paper 2: Corporate Laws | Paper 2: Corporate and Other Laws |

| Paper 3: Cost and Management Accounting | Paper 3: Cost and Management Accounting |

| Paper 4: Taxation | Paper 4: Taxation |

| Paper-5: Auditing and Code of Ethics | Paper 6: Auditing and Assurance |

| Paper-6A: Financial Management (Marks 50) Paper-6B:Strategic Management (Marks 50) |

Paper 7: Enterprise Information Systems & Strategic Management Paper-8: Financial Management & Economics for Finance |

The ICAI has proposed that the CA Intermediate course be reduced to 6 papers instead of 8.

Specifically, Paper 1 and 5 have been combined into one paper called Advanced Accounting.

Enterprise Information Systems has been removed from Paper 7 while Economics for Finance has been removed from Paper 8. The remaining material has been merged into Paper 6 as Financial Management and Strategic Management (50 marks + 50 marks).

Additionally, Paper 2 of Corporate Law will cover the Companies Act entirely and its portion of Business Law will now be covered at the CA Foundation level.

CA Intermediate Passing Criteria

The regulations for the CA Intermediate exams have been altered, and now 30% of the questions in all 6 papers will be MCQ based questions. Additionally, a negative marking of .25 will be applied for every incorrect answer.

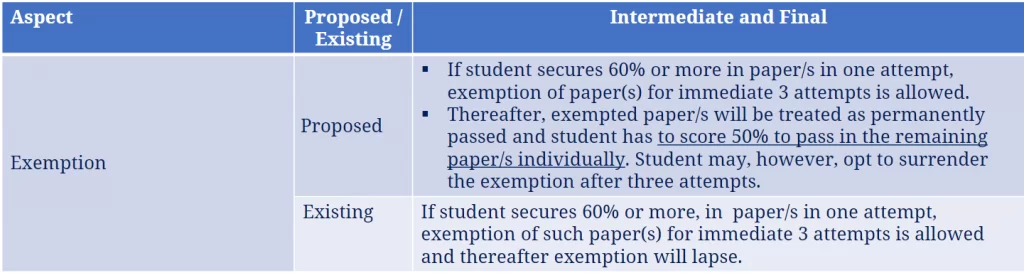

In the exemption criteria for CA Intermediate, if you receive an exemption for any paper with the new scheme, it will be a permanent exemption for that paper, with the ICAI considering it as having been permanently passed. However, you must still obtain 50% marks or higher in the remaining papers.

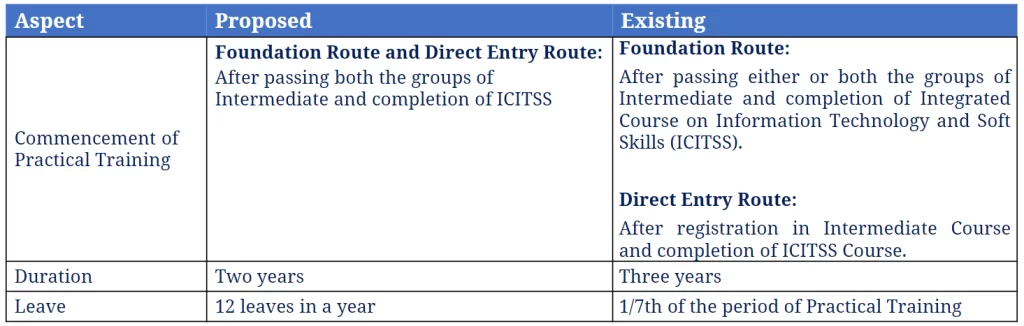

CA Articleship Training under New Scheme 2023

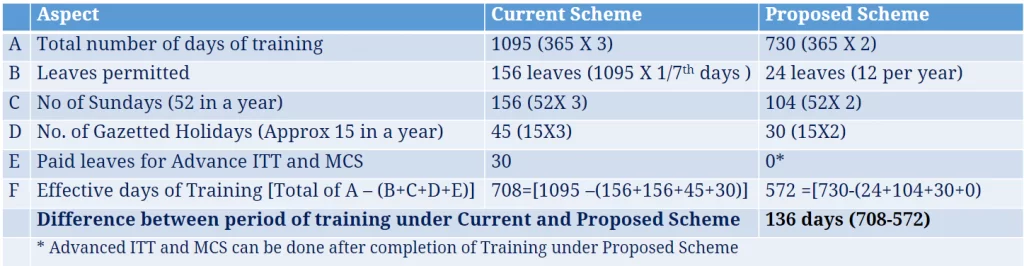

The Institute of Chartered Accountants of India (ICAI) has proposed a major change to the CA Articleship Training Program that will be beneficial for students. The duration of the program has been reduced from 3 to 2 years, which is great news for CA aspirants as they can now become chartered accountants more quickly than before. However, for those who wish to become practitioners, there is a requirement of having one year of experience in a Chartered Accountancy firm in order to receive a certificate of practice.

Those with existing CA qualifications who have worked for one year in a CA firm in the last 5 years are exempt from this requirement, as are those who want to do a job.

Students can do industrial training for a period between nine months and a year (in the last 1 year of the articleship)

CA Articleship Eligibility Criteria

Under the CA new scheme 2023, students will gain an advantage as they will no longer need to stress about exam preparation, as they only need to pass both groups of the CA Intermediate exam and finish the ICITSS training to start the articleship training.

CA Articleship Stipend, many students have routinely voiced their grievances regarding the inadequate CA articleship stipend. Thus, ICAI has taken the decision to increase the 100% stipend amount.

CA Articleship Leaves

Due to the lack of exams during practical training, the Institute of Chartered Accountants of India has lowered the number of permissible absences. Students are now only allowed to take 12 days leave in a single year, or a total of 24 days during the two years.

ICAI Self-paced Online Modules

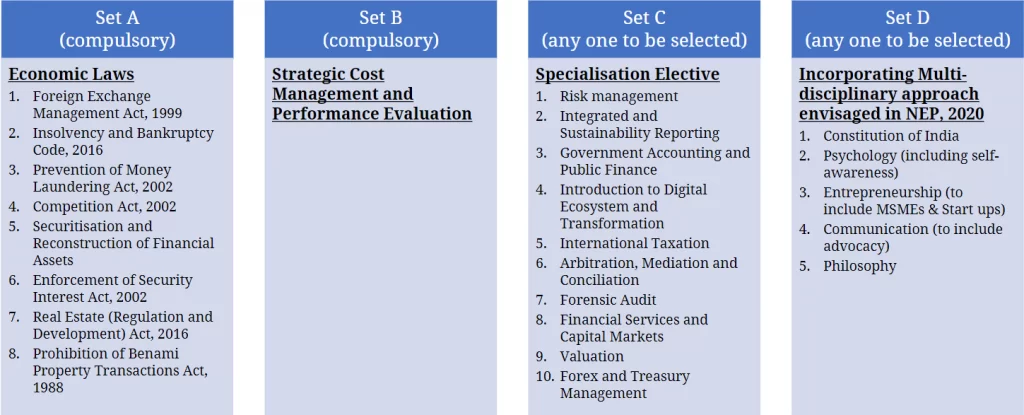

The Institute of Chartered Accountants of India (ICAI) has implemented a new system of education and training which includes self-paced modules. Students can study through these modules at their own pace and give online exams.

In order to qualify for the CA Final exams, students must pass four sets with more than 50% marks in each.

Sets A and B, which are Economics Law and Strategic Cost Management, are mandatory and are also part of the removed subjects of the CA Final old course.

In the other two sets, students can select a topic of their own preference. They can study for these self-paced modules online while participating in the articleship training and take their exams at the same time.

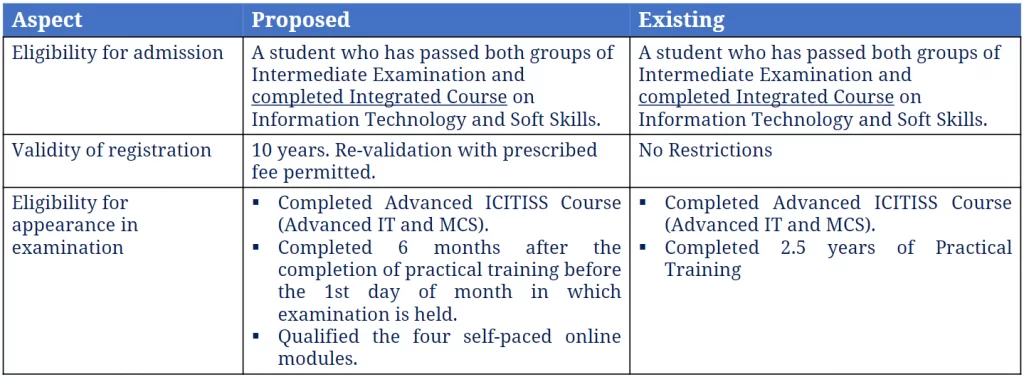

ICAI CA Final New Scheme and Old Scheme Differences

In under new scheme of education and training, CA Final eligibility and registration:

In order to qualify to register in the CA Final course, students must have passed both groups of the CA Intermediate examination and completed the ICITSS training.

In order to be appear to take the CA Final exams, students must finish:

- The Advanced ICITISS Course

- Complete six months to studying after their practical training is completed

- Pass all four self-paced modules.

The CA Final registration has a 10-year validity period. Those wishing to continue their registration must renew it after 10 years by paying the required fee.

CA Final New Syllabus 2023

Under the CA Final new scheme 2023, the ICAI has reduced the number of CA Final papers from 8 to 6, dividing them into two groups with three papers in each.

Significant alterations made to the CA Final Subjects are:

- Papers 4 and 5 have been removed and included in the self-paced modules.

- There will not be any options available in Paper 6, which will become a Multi-disciplinary case study with Strategic Management.

- Elective subjects such as risk management and financial services and capital markets are now a part of Set C of the self-paced modules.

| New Syllabus | Old Syllabus |

| Paper 1: Financial Reporting | Paper 1: Financial Reporting |

| Paper 2: Advanced Financial Management | Paper 2: Strategic Financial Management |

| Paper 3: Advanced Auditing and Professional Ethics | Paper 3: Advanced Auditing and Professional Ethics |

| Under Self-Paced Online Mandatory Module | Paper 4: Corporate and Economic Laws |

| Under Self-Paced Online Mandatory Module | Paper 5: Strategic Cost Management and Performance Evaluation |

| Paper 4: Direct Tax Laws and International Taxation | Paper 7: Direct Tax Laws and International Taxation |

| Paper 5: Indirect Tax Laws | Paper 8: Indirect Tax Laws |

CA Final Exam Pattern under new scheme 2023

Regarding the CA Final 2022 exam, the same format of 30% MCQ-based questions with a negative marking of 25% for incorrect objective responses will be implemented as the CA Intermediate 2022.

As for the exemption rules, these remain the same as for the Intermediate exam. To keep up-to-date with the latest information about the CA Final November 2022 result, please refer to this comprehensive article.

Conclusion

The ICAI recently proposed a CA new scheme of education and training that will begin from the next year’s exams. This new course is designed to give future Chartered Accountants an advantage in the international markets by providing them with an up-to-date education.

Stay connected with the MCC website for more ICAI updates.